The Trust Deficit in AI Infrastructure Expansion

- ctsmithiii

- Oct 16, 2025

- 7 min read

Updated: Oct 17, 2025

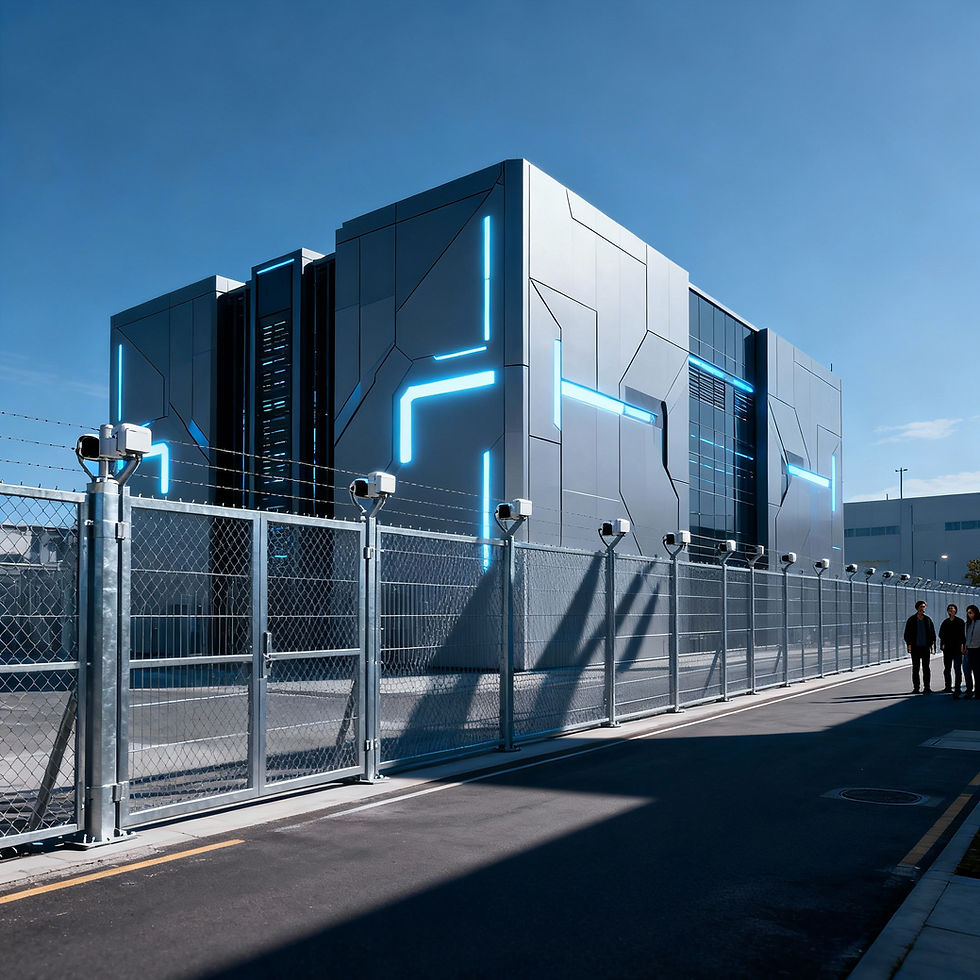

Communities reject billion-dollar data centers while the industry bets trillions on AI. Why trust and infrastructure reality matter more than capital.

Communities are hitting the brakes on data center projects while the industry bets trillions on AI. The disconnect reveals a fundamental problem that money alone can't solve.

Tarboro, North Carolina, recently rejected a multi-billion-dollar data center project. Jerome Township in Ohio approved a nine-month moratorium on new facilities. St. Louis's top urban planning official recommended pausing all data center construction.

This is happening while Meta announces $72 billion in AI infrastructure spending this year. OpenAI plans to build $1 trillion worth of data centers. The industry is racing forward at unprecedented speed, but communities across the country are putting the brakes on.

The collision between these two realities was the central theme at the infra/STRUCTURE Summit in Las Vegas this week, where Structure Research brought together data center operators, power providers, investors, and industry leaders to address the challenges facing digital infrastructure expansion.

The Scale of What's Coming

The numbers are staggering. OpenAI projects demand 100 gigawatts of computing capacity. That's enough power to light 100 million LED bulbs. Meta just announced a gigawatt-sized data center in El Paso, Texas, as part of a buildout that includes 29 facilities globally.

"There's never been anything like this," said one panelist at the Structure Research event. "We've gone from millions to billions to tens of billions, hundreds of billions, and now the T word is being thrown around like it's nothing."

Even OpenAI CEO Sam Altman acknowledges the risk. "Someone is going to lose a phenomenal amount of money," he told The Verge, though he believes winners will gain even more.

But there's a problem the industry didn't anticipate: communities are saying no.

Why Communities Are Pushing Back

Bill Thomson, VP of Product Management at DC BLOX, the largest connected data center operator in the Southeast, has seen this resistance firsthand.

"We had land rights, we had by-right development that was approved, and then some community members started raising concerns," Thomson explained. "The county council members decided to respond to constituents rather than educate them about the positives."

The project stalled despite being in an area already zoned industrial and specifically approved for data center development. Local politics changed the rules midstream.

"There's spreading so much disinformation," Thomson said. "People don't really know what a data center is, but they think it's bad."

The resistance isn't limited to one region. Communities from North Carolina to Ohio are implementing moratoriums or rejecting projects worth billions. The concerns center on power grid strain, water usage, and the perceived lack of job creation compared to traditional manufacturing.

The Infrastructure Reality No One Saw Coming

Behind the community pushback lies a deeper problem: the existing infrastructure simply can't support what the industry is trying to build.

David Dorman, Director of Commercial Operations at APR Energy, which specializes in rapid power deployment, explained the timeline challenge during a briefing at the Structure Research conference.

"On average, I've been hearing anywhere from two to seven years' delays in getting infrastructure to these facilities," Dorman said. "A gigawatt of power would take some time - not mainly for equipment, but for the infrastructure outside."

APR Energy keeps close to a gigawatt of mobile power generation equipment in stock specifically for this problem. Their typical installation takes 30 to 90 days, but that's only possible once roads, foundations, and basic infrastructure are in place.

The bottleneck isn't money. Companies are willing to pay for substations and transmission lines. The problem is supply chain constraints, labor shortages, and utility companies that aren't equipped to handle this level of demand.

"I foresee a bridge solution needed for a lot of these projects," Dorman said. "Until that infrastructure and utilities are able to bring power to them, behind-the-meter solutions will be necessary."

In other words, temporary is becoming permanent because the grid infrastructure isn't materializing fast enough.

The Utility Disconnect

Thomson describes the situation as a "clash of cultures."

"Most of us in the data center industry are very aggressive risk takers, flexible and adapting to market opportunities," he said. "Utilities, not so much. Very conservative, different business operating models."

Many utilities experienced flat electricity demand for at least a decade before 2022. They built efficiencies into the system and avoided capital expenditures. Then AI changed everything.

"All of a sudden, data centers and AI came and literally changed everything - 20 to 30 times the demand," Thomson said.

The utility response has created new challenges. Some utility companies now require commitments to use 80% of the requested power over 20 megawatts within a specific timeframe. For colocation providers like DC BLOX, that's impossible without signed customers.

"You're going to box out the majority of the market - like 80% of the market - by these kinds of policies," Thomson explained. "Colocation third-party development of data centers is five times what self-builds are."

Duke Energy in Florida is asking regulators for an entirely new rate framework because the company doesn't currently serve large-scale data centers. The industry assumed working through utilities would be the path of least resistance. They were wrong.

One Company's Solution: Building Trust First

DC BLOX offers a case study in how to navigate this landscape successfully. Their approach in Rockdale County, Georgia, shows what's possible when companies engage proactively.

The county initially chose DC BLOX over a distribution warehouse that would have brought truck traffic, diesel fumes, and demands for expanded schools and infrastructure.

"We said we're building this data center with 20 to 25 people, 24/7, so no traffic, no burden on roads or infrastructure," Thomson recalled. "But here's the tax dollars - hundreds of millions over 10 years."

The county approved the project. But as DC BLOX began construction and news about data centers spread, questions started coming back. Community members worried about power consumption and water usage.

DC BLOX's response: aggressive community engagement.

"We have a field marketing team that goes in and penetrates and volunteers, makes donations, and engages with the business communities," Thomson said. The company has held at least two dozen meetings at the executive level in Rockdale County this year alone.

They also built something more tangible: a dark fiber network connecting 26 counties in South Carolina and Georgia. The fiber route passes through mostly rural areas that previously lacked high-capacity internet infrastructure.

"We put that superhighway in place, which can be used for local businesses and ISPs to connect these communities," Thomson explained. "When we say we're building this data center, it's going to be connected to very high-capacity fiber that can benefit the entire region."

That story resonates. Communities see tangible benefits beyond tax revenue.

The Educational Gap

Structure Research's infra/STRUCTURE Summit exists specifically to bridge the knowledge gap that's creating these conflicts. Jabez Tan, the Structure's head of research, noted in his opening remarks that the industry faces unprecedented challenges happening simultaneously.

"There are just so many different things happening at once," Tan said. "Resource constraints while we're tracking massive demand. Planning timelines used to be a few years, now looking up to a decade."

The event brings together the entire ecosystem - operators, utilities, investors, power providers - to address these challenges collaboratively. But the broader public education challenge remains.

Thomson recounted taking students at Coastal Carolina on a digital infrastructure tour, asking them to perform a task on their cell phones and then explaining the journey: from Wi-Fi or cellular networks to fiber networks underground to data centers running servers and applications.

"How long did that take you?" he asked them. "Less than a second. We just need to educate the world about how they depend on this digital infrastructure every day."

What Happens Next

Thomson believes the current wave of resistance will eventually pass.

"I think this wave of 'we don't really know what a data center is, but we think it's bad' will ebb," he said. "We'll start seeing people saying, 'Oh wow, actually this was a great investment.'"

He draws a parallel to cell phone towers. Nobody wanted them in their backyard, but everyone needed cell phone service. Eventually, the value became undeniable.

But getting to that point requires the industry to change its approach. The days of announcing projects and expecting approval are over. Communities want honest conversations about trade-offs, tangible benefits beyond tax revenue, and proof that infrastructure won't strain their resources.

Dorman sees the infrastructure constraints as a natural brake on the industry's ambitions.

"I think the timelines are extremely difficult," he said when asked about OpenAI's 100-gigawatt plans. "That's going to be very difficult to achieve in a timeline within a decade. Supply chain constraints, labor constraints - there's a lot of things that need to change."

Money can solve some problems, such as accelerating supply chains and attracting labor. But it can't overcome the fundamental reality that building gigawatt-scale infrastructure takes time, requires community support, and demands coordination across multiple parties with very different operating models.

The industry is learning this lesson the hard way, one rejected project at a time.

The Winners and Losers

Thomson frames the situation starkly: "The haves and the have-nots, the winners and the losers, are going to happen faster than ever."

He means businesses adopting AI, but the same applies to communities and states. Those with proactive policies that accelerate infrastructure development will capture economic benefits. Those who resist will fall behind.

"If you just stick your head in the sand, you're going to get left behind," Thomson said. "China's not worried about carbon emissions. They see the future, and they're investing heavily in energy infrastructure."

Recent reports show China is building data centers at 10,000 feet in Tibet next to massive solar farms, where power costs are 40% lower and cooling needs drop by 40%. Meanwhile, American communities are rejecting projects in established markets.

The question isn't whether AI infrastructure will get built. The industry has too much conviction and capital behind it. The question is where it gets built, how long it takes, and whether communities benefit or just bear the burden.

Right now, the answer to that question is still being written. But one thing is clear: the old playbook doesn't work anymore. Trust has to be earned before ground is broken. Infrastructure benefits need to be tangible and local. And the industry needs to accept that communities have legitimate concerns that deserve real answers.

The companies that figure this out will win. Those that don't will keep hitting walls they never saw coming.

Comments